The banking industry as a whole has seen significant changes in recent years, including retail banking. Despite the fact that the number of banks has likely decreased as a result of mergers and other market developments, those that have remained tend to have a substantial network of retail bank branches.

Sd Wan Edge Devices by be.Sdx offers a wide range of services to the retail banking industry.

Why Wan Edge is important for retail banking?

Competition in the retail banking sector is tightening, as it is in many other market categories, due not only to competition between stronger retail banks but also to competition from an ever-growing internet banking sector. All of this has lowered bank branch margins, but these branches have also had to maintain a high degree of security, quality, and reliability in all of their operations, including telephones.

Challenges faced in the retail banking system.

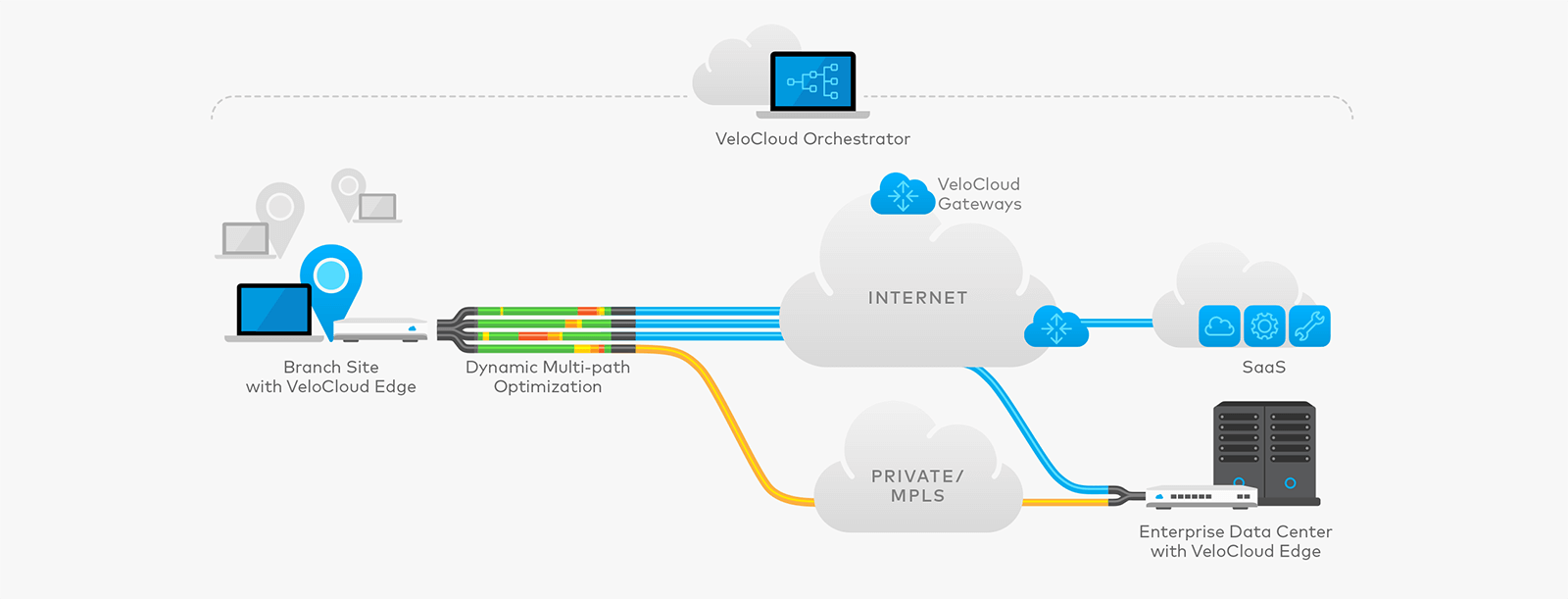

- Over the previous few years, many aspects of IT and telecommunications in retail bank offices have undergone significant modifications. Bank branches are growing their usage of cloud apps, which does not fit well into the traditional structure of having bank branches directly connected to the bank’s private data centers via private circuits, as it does in many other market segments.

- The use of Sd Wan Edge Device for videos and video conferencing over the bank communications network has increased, and this trend is expected to continue, as it can significantly reduce costs and improve the efficiency of bank personnel by eliminating the need for them to travel from the bank to central sites, training centers, and other locations.

- All of these changes must be addressed and resolved with the understanding that, aside from private bank circuits, any movement of communication networks and systems must be able to provide extremely high levels of security, quality, and reliability. Anything less would be unacceptable to the bank and its customers because any network outage costs money.

Takeaway

There are numerous benefits of the be.SDx for any retail bank, but a few stick out.

Be.SDx can be implemented in a customized manner that includes only the SD-WAN functionality that each retail banking organization needs. Aside from the cost, it allows the bank to have complete control and, of course, to employ a hybrid network structure so that private circuits can be maintained if desired, for specific traffic that the bank wishes to pin to the private network.